Gen Z and Millennials Want Virtual Financial Advice

Prior to the internet, financial advice was found mainly at the library or from a trusted advisor who worked in the financial services field—even better if they were a certified financial planner or advisor. But the internet made it much easier to find information about financial markets and instruments. Eventually, amateurs were able to make trades without having to call a stockbroker and could use tools like Mint to easily track all of their financial assets in one place.

Smartphones and financial management apps like Robinhood made it even easier for individuals to manage their portfolios. High-risk/high-reward trades that were generally only made by hedge funds or complex trading algorithms are now possible with the tap of a button on a smartphone. Because of this transformation, retail investors now account for 52% of global assets under management, and is expected to grow to over 61% by 2030. Financial advisors must acknowledge, and then address, this growing threat to their livelihoods as more consumers take financial planning into their own hands.

Younger Generations Do Want Financial Advice—But On Their Terms

While younger generations are more eager to manage their own finances, 71% of Gen Z and 72% of Millennials say there are financial topics they want trustworthy advice on but aren’t sure how to get it. COVID-19 accelerated this trend, and over 50% of Gen Z now say they are motivated to increase their financial literacy, followed closely by Gen Y and Gen X.

Prior to COVID-19, only 2% of financial advisors conducted meetings with clients virtually. But that number has increased to 48%. So, while younger consumers want more control of their financial future, they are still inclined to meet with financial advisors—as long as the meetings can be flexible and meet some or all of the time virtually.

How to Run an Effective Virtual Meeting for Your Clients

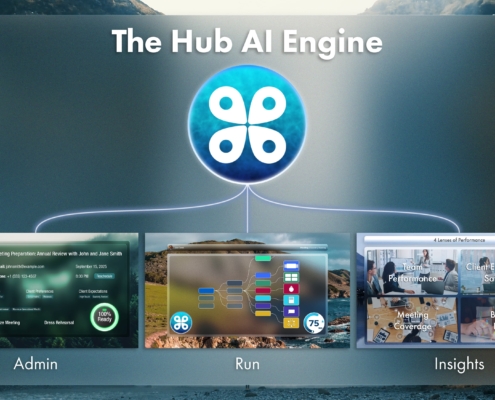

To make financial advisor meetings as valuable as possible for your clients, we’ve built The Conversation Hub to help keep your meetings:

- Structured – An agenda is critical to helping your client understand what you’re hoping to accomplish on the call.

- Guided – Guide your client through a checklist of items that are relevant to them like tax planning, retirement, estate planning, etc.

- Visually Engaging – Ditch the PowerPoint and spreadsheets. Make sure your presentation is visually engaging, so your client maintains interest.

- Updated – Old data doesn’t help. Your presentation should have up-to-the-minute information so you and your client can discuss the best path forward.

- Paced Correctly – Keep track of time and ensure that you aren’t getting sidetracked on one item.

- In Compliance – Due to many regulations for financial data, it’s important that you ensure all compliance needs are met when presenting information.

- Automated – Don’t worry about taking notes during the call. With The Conversation Hub, information is collected as you go, and the data integrates with your existing systems and workflows automatically.

With The Conversation Hub, it’s easier than ever to ensure that your client meetings drive value and build lasting loyalty. Book a free demo to start hosting better virtual meetings today!