The future of financial advice is beyond wealth and it starts in the client meeting

For years, “financial advice” has been shorthand for one thing: managing a pot of money.

AUM, performance reports, model portfolios, fee schedules. Important, yes, but increasingly incomplete. Clients aren’t just asking, “Am I on track?” They’re asking:

-

Will I have choices when I’m older?

-

Can I change careers without blowing everything up?

-

How do I support my kids and still protect my own future?

-

How do I balance caring for parents, health, and work?

-

Am I actually using my money to live the life I want?

The future of advice is bigger than wealth. It is about life decisions, wellbeing, relationships, time, and meaning, with money as the enabler, not the headline.

And if advice is going beyond wealth, the client meeting has to go beyond a portfolio review.

That is where The Meetings Hub comes in. By turning every meeting into a hyper-personal, visual conversation, it helps advisors connect with clients as people, not just as portfolios.

1. Advice has moved on. Meeting formats have not.

Most review meetings still look like this:

-

A stack of PDFs or slides

-

Performance charts few clients really understand

-

A quick “Any questions?” at the end

-

A sense that the real life issues never quite made it onto the screen

Yet the reality of most client conversations now is:

-

Career changes and sabbaticals

-

Mental load and burnout

-

Caring for children and parents at the same time

-

Relationship shifts and blended families

-

Health fears, longevity, “what happens if…?” scenarios

Advisors already talk about these things.

The problem is that the meeting infrastructure is still built for wealth-only discussions.

If the only thing that makes it onto the screen is a performance report, the message is clear, even if unintentional:

“What we can see and work on together is the money. The rest is optional.”

The future flips that.

Money is the support act. The client’s life is the main event.

2. Beyond wealth means beyond one-dimensional visuals

If advice is going beyond wealth, the meeting needs to show:

-

Goals across life domains: career, health, family, lifestyle, contribution

-

Trade-offs between time, money, and energy

-

The emotional journey, not just the financial one

-

Progress in ways that feel tangible and human

Text and tables cannot carry that on their own.

You need visuals that can:

-

Make complex decisions feel simple

-

Put “life topics” on the same level as “wealth topics”

-

Help clients see themselves in the picture

That requires more than a better PowerPoint. It requires a visual meeting environment built for advice conversations.

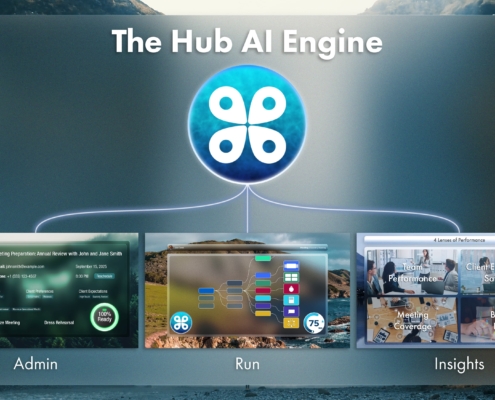

3. The Meetings Hub: a visual layer for advice beyond wealth

The Meetings Hub is a meeting-performance platform designed for financial advice firms.

At its core are Meeting Maps. These are structured, visual pathways that guide advisors and clients through each meeting in a clear, logical way, whether the topic is investment performance, retirement income, a career break, a new business, or long-term care.

Instead of jumping between PDFs, planning tools and notes, the advisor and client share a single visual space that brings all of this together.

What that looks like in practice

In a Meetings Hub session, you might move through:

-

A visual map of the client’s life domains, not just accounts

-

Icons and illustrations for key goals and milestones across work, health, family, and lifestyle

-

Simple visuals for trade-offs: work longer vs. retire earlier, keep the house vs. downsize, invest more vs. reduce stress

-

A clear, visual summary of decisions and next steps at the end

The conversation feels different because the screen is different.

The client is not looking at “your report.” They are looking at their life.

4. Better visuals = deeper human connection

This is not about making meetings look pretty. It is about using visuals to do what words and numbers often cannot.

a) Make space for the real conversation

When clients see their life mapped out visually, they are more likely to say things like:

-

“That goal does not really matter anymore.”

-

“This is the bit that scares me.”

-

“I did not realise how much I was prioritizing others over myself.”

The visual gives them permission to point, question, and re-prioritize.

That is where real advice happens.

b) Turn anxiety into clarity

Many clients arrive at meetings with vague anxiety:

“I am worried, but I cannot quite say why.”

A Meeting Map lets the advisor:

-

Lay out the moving pieces one by one

-

Show what is under control and what needs attention

-

Highlight options in a calm, structured way

Instead of drowning in detail, clients see a manageable path forward.

c) Help both sides stay present

When the visual structure holds the conversation:

-

The advisor does not have to mentally juggle “what did we cover, what is next, what did I miss?”

-

The client is not trying to decode charts and jargon on the fly

That frees up attention for eye contact, listening, and real human connection, the things clients actually remember.

5. Memory and context: every meeting builds on the last

Going beyond wealth also means going beyond one-off snapshots.

A client’s story unfolds over years. New jobs, relationships, health events, moves, businesses started or sold, parents getting older, kids becoming adults.

The Meetings Hub is built to remember that story.

-

Short-term memory: what you discussed and decided in the last meeting

-

Long-term memory: the deeper context such as values, fears, promises, and non-negotiables

Meeting Maps store and retrieve this structured context efficiently, so every meeting starts from:

“Here is where we left off. Here is what has changed. Here is what matters now.”

That is essential if you want to advise on a life, not just a portfolio.

6. A new metric for this new kind of advice: Meeting Quality (MQ)

If the future of advice is beyond wealth, the firm needs a way to measure the quality of these broader conversations without turning them into box-ticking exercises.

The Meetings Hub introduces Meeting Quality (MQ) as a practical way to do that.

Because meetings run through structured Meeting Maps, MQ can look at things like:

-

Were the client’s key life domains actually discussed?

-

Did the client clearly understand the trade-offs and decisions?

-

Were goals and concerns updated, not just balances?

-

Did we leave with agreed actions and next steps?

This gives leaders:

-

A view into how consistently advisors are delivering this richer version of advice

-

A way to coach and develop advisors based on real meeting dynamics

-

A way to connect better meetings with better outcomes such as retention, referrals, and implementation

MQ makes the shift beyond wealth visible and operational, not just aspirational.

7. So what does “beyond wealth” actually feel like to a client?

From a client’s perspective, an advice relationship powered by The Meetings Hub feels less like:

-

“They show me my portfolio twice a year.”

and more like:

-

“They know what is happening in my life.”

-

“They explain things in a way I can see and feel, not just hear.”

-

“Our meetings actually help me make decisions, not just look at numbers.”

-

“I leave calmer and clearer than when I arrived.”

That is the gap The Meetings Hub is built to close.

8. The future is already in the room

Most advisors are already having “beyond wealth” conversations.

What is missing is the environment that matches that ambition, a meeting space that:

-

Puts the client’s life at the center

-

Uses visuals to make complexity human

-

Remembers the story over time

-

Measures and improves the quality of those meetings across the firm

The Meetings Hub does not replace your planning tools, CRMs, or investment platforms. It sits above them as the visual, intelligent meeting layer that finally matches where advice is going.

The future of financial advice is not just more wealth.

It is better lives, better decisions, and better conversations.

And that future starts in the meeting.